When Does It Make Sense to Build a Real Estate Investment?

Disclaimer: The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.

- Amanda Farrell

- November 9, 2022

- 10:27 am

- No Comments

The latest numbers on single-family homebuilding are grim. CNBC reports that homebuilder sentiment dropped to the lowest level since 2012, barring the brief decline at the beginning of the coronavirus pandemic. It stands at 38, half of what it was six months ago. Anything below 50 is considered negative. Chief Economist for the National Association of Homebuilders (NAHB) predicts that this will be the first year since 2011 to see a decline in single-family starts.

A major contributing factor to the troublesome outlook is the speed at which mortgage rates have shot up in the last few months. Housing shortages have plagued the market for years, and the imbalance between demand and supply, paired with rock-bottom mortgage rates, led to intense bidding wars in 2020 and 2021. List prices were pushed to greater heights as the median sales price hit its historical peak in 2021 at $386,000, later crushed once again in the first quarter of 2022 at a median price of $428,700. Sellers have had the upper hand, and they knew it.

Now, homes are selling below their list price for the first time since March of 2021. After 18 months, the party for sellers seems to be over. Whether you call it a crash, a correction, or a “return to normalcy” in the housing market after the unusual activity caused by the pandemic, the downward shift in demand is worrying homebuilders. Add that to elevated input costs, labor shortages, and persistent supply chain issues, and housing starts decreased by 19% year over year in September.

Despite the drop in prices, inventory remains an issue for many buyers. For investors looking for their next deal and coming up short on options, it’s worth wondering if building the next investment makes sense. The typical build-to-rent plan focuses on larger commercial projects, like planned communities. Still, as new housing starts slow and inventory remains low, investors interested in single-family or smaller multi-family residents might consider turning to construction.

Deciding to build instead of buy depends on an investor’s willingness to take on new risks, investment strategy, and financing options. Here are a few things to consider before contacting a contractor.

Investing comes with risk. When it comes to real estate, buying requires understanding the core risks associated with your asset, investment strategy, and market. Even for well-seasoned investors in buying and selling properties, building presents a new layer of challenges and subsequent risks, not all of which are predictable.

Common risks include:

- Idiosyncratic risks

- General market risks

- Location risks

- Asset risks

When constructing an investment property, issues unique to that undeveloped land create idiosyncratic risks. One barrier to building may be the local permitting office. Depending on the municipality, specific projects, like short-term rentals, may be unwelcome. Before finalizing the blueprints and seeking financing, investors should confirm that their project meets a municipality’s codes and design standards.

Even if the project fits the guidelines, working with a local construction company or contractor will help navigate the process better. Delays in permitting, inspections, and issuing a certificate of occupancy can significantly impact the return on investment and even threaten the completion of the project.

The same general market risks apply to building a property as it does to buying. Examining common metrics like job growth, population growth, and household information like income help determine if a property is likely to maintain a good return on investment. If the local market stagnates, then expect your returns to flatline.

Local market constraints like labor shortages can also impact the budget and timeline.

For instance, South Florida’s construction industry has been booming despite grappling with the same supply-chain issues and labor shortages facing the nation. Before Hurricane Ian, those problems were predictable and manageable. After the storm, the cost of building in the area will likely rise along with insurance costs to hold the property. While larger investment firms with the capital can withstand these unexpected costs to build or rebuild a property, smaller landlords may not have deep enough pockets to sustain their assets.

Building in a familiar market will help investors better predict future appreciation, vacancy rates, and cash flow. Still, even with that intimate knowledge, location risks can shift in a short period. The appeal of a particular city or neighborhood may change within the time it takes to construct a new property.

Asset risks include the type of property, its age, its condition, and whether it fits the demands of the current rental market. Commercial investors often analyze asset risks alongside location risks by assigning a rating of A, B, C, or D to each. If the location receives high marks on employment and population growth but the property is in disrepair, the final grade might not pass the risk tolerance check. Fortunately, building instead of buying can hedge against such unexpected maintenance and operating costs, but the property and its intended use should suit the neighborhood and potential renter pool. This is where having a clear investing strategy can help guide the decision to buy or build.

There are many other risks to evaluate, but general risks can become more localized and heightened when it comes to building versus buying. Getting granular and understanding how each risk factor influences another is key to successfully building a real estate investment property.

Aligning Investment Strategies with Market Shifts

Most build-to-rent projects (B2R or BFR) involve a community of single-family residential houses constructed in a suburban area for long-term renters. Although traditional detached single-family homes are common in a B2R community, duplexes, condos, townhomes, and small lot homes are also constructed.

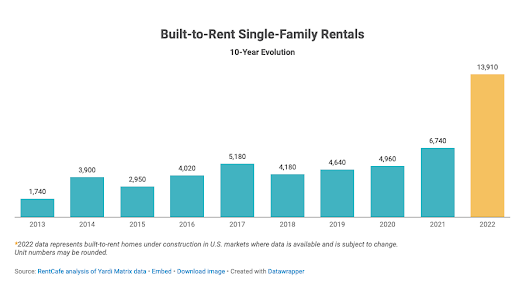

The monthly rent of these units is usually higher than a standard apartment, but the amenities make the monthly payment worth it to many. Living in a B2R community often comes with access to pools and gyms, low maintenance, and a quiet suburban atmosphere ideal for small families. While a few analysts are raising the alarm about the sustainability of this model, the success so far is a testament to these projects fulfilling a market need. Despite the criticisms, B2R properties are projected to more than double in 2022, according to rentcafe.com.

The lesson here is that even if the traditional B2R model doesn’t fit your current investing goals, success in building a real estate investment property requires a firm grasp of risk analysis.

Whether you’re focused on long-term rentals, short-term rentals, single-family, multi-family, or a mix, aligning your strategy with renter expectations and local market growth projections will ensure the longevity of your investment.

Is It Better to Build Long-Term or Short-Term Rentals?

The answer depends on desired yield and location.

While short-term rentals are known for higher income potential, not all markets are ideal for this asset class. On the other hand, building a short-term rental provides complete control over the environment and an opportunity to create truly eye-catching and memorable vacation rentals. Unique properties are more likely to pique the interest of vacationers and increase bookings.

One investor, Alex Jarbo of Sargon Investments, has made Instagrammable A-frame cabins nestled in the mountains the focus of his strategy. His first cabin listed on Airbnb rents for almost $300 a night.

Of course, short-term rentals won’t work for everyone in every market. In certain cities, building long-term rentals may be the only option as municipalities crack down on short-term rentals. The high guest overturn requires more active management and marketing than a long-term rental. Self-managing can preserve the net revenue that makes short-term rentals more appealing in the first place, but it’s not for everyone. If hiking your real estate investment business out to a rural mountain market sounds too risky, building long-term investments in your backyard may be the better alternative.

It’s easy to default to a long-term versus short-term rental mindset, but ultimately, diversifying a portfolio with both asset types is a practical form of wealth protection.

Related Reading: Shifting to a Hospitality Mindset for Short-Term Vacation Rentals

Financing Options for REI Construction

While construction provides an opportunity to create beautiful and unique properties, the cost of capital to build can be more prohibitive than buying. Although the market may not offer exactly what you’re looking for, comparing your ROI for buying versus building is essential. It’s hard to account for the unexpected when building. Weather, delays with the municipality, supply chain issues, and more can quickly derail a project.

Even if the numbers to build make sense, finding financing to back the project can be an obstacle. Many traditional lenders are hesitant to give out loans on undeveloped land because it’s hard to resell if the borrower defaults on their loan.

Here are a few routes to finance the construction of real estate investments:

- Leverage equity in other investments. For investors with other assets, a cash-out refinance may be the best way to purchase land to start the project.

- Hard money loan. A hard money loan or short-term bridge loan will likely come with steeper terms, making the cost of capital more expensive. Still, it may be the only option if other avenues of financing are unavailable. Delays are often inevitable in construction, so the longer it takes to finish the project, the more expensive these loans will become. Investors might want to consider a larger contingency budget to avoid defaulting.

- Local banks and credit unions. Smaller lending institutions with professionals who know the area are often more open to financing land to build a long-term or short-term rental. However, many will want a larger down payment of around 15% – 20% because these loans often carry more risk.

- Construction loan. After securing the financing for the land, another short-term loan to complete the construction is often needed. Later, an investor can refinance into a long-term mortgage with better rates.

- Hospitality lenders. If building a short-term rental, a hospitality lender may be willing to finance it with a “micro-resort” loan. These loans are specifically designed to underwrite projects like hotels, bed and breakfasts, motels, inns, and hostels.

- Joint venture. Another investor with deeper pockets may be open to offering the capital or guaranteeing the loan if the property is projected to have the right cash flow yield.

While the build-to-rent model often conjures images of large-scale communities funded by wall street investors, the concept can be easily applied to a vacation rental, a duplex, or a single-family house. There are additional risks to consider, but even smaller investors have succeeded in growing their businesses by building in the right market.

Whether buying, building, or selling, Blueprint’s processes and technology are designed to accelerate the acquisitions and dispositions of single-family and smaller multi-family rental properties. Our team specializes in the complex transactions associated with real estate investing, like novations, assignments, and double closings. We’re focused on developing a more tailored title and closing experience for investors, wholesalers, proptech companies, and lenders. With our Status Tracker and API, submitting and tracking your transaction from contract to closing is more transparent.

With Blueprint, you can reduce your time organizing, managing, and signing closing documents. That leaves more time for more deals and more doors. Schedule a demo to learn more.