Is Real Estate Still a Good Investment?

Disclaimer: The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.

Homes are selling like hotcakes as we head into the spring market, a popular time for home buyers to begin their search. The average home spent only 61 days on the market in January, according to Realtor.com. That’s down 10 days from the same time last year

The early frenzy is likely, in part, due to rising interest rates and the likelihood that the Federal Reserve will hike rates throughout 2022. Tight housing inventory also means that more buyers are willing to compromise to get into a house, any house.

Certain circles think this activity feels similar to the lead-up to the 2008 housing market crash. The common question asked “Is it really worth that?” can be heard all over the internet and on social media. Would-be first-time home buyers are particularly skeptical. No doubt, it’s a seller’s market, but that shouldn’t deter serious investors from passing up on good opportunities that still exist. Instead, it’s a matter of understanding what’s different about today’s market and knowing what kind of investing strategy to apply.

New oversight for lending after the housing market crash

In response to the 2008 financial crisis, the Consumer Financial Protection Bureau (CFPB) was created to curb predatory lending practices that caused subprime mortgages to flood the market. The TILA-RESPA Integrated Disclosures (TRID) rule required new forms with simplified language to make it easier for consumers to understand the terms of their loans before signing a mortgage note.

Most importantly, the CFPB requires lenders underwriting subprime mortgages to complete the “ability-to-repay” (ATR) provision to determine whether a borrower can handle the monthly payments.

Financial risks will never be eliminated, but sensible regulations in place today help make the broader economy more insulated from the domino effect of the most recent housing crisis.

Real Estate Phases: What goes up must come down?

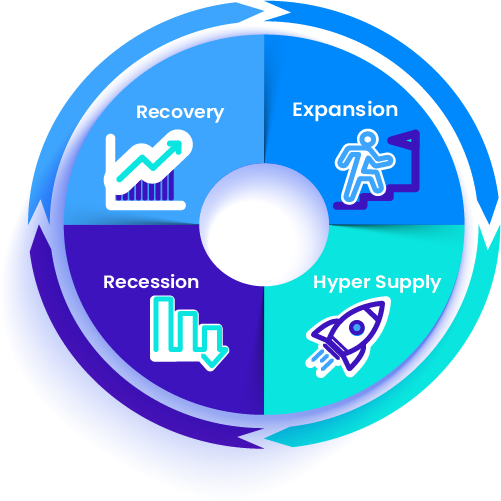

While a major crash like 2008 is unlikely, that doesn’t mean that prices will keep rising forever. At one point in the future, a better balance will be reached. Eventually, inventory and demand will flip. Like the stock market, real estate may seem like a roller coaster of ups and downs. However, it’s more like a Ferris wheel – or a cycle – with four phases.

Understanding which phase of the real estate cycle the market is in helps investors execute the best buying and selling strategies.

The Four Phases of the Real Estate Cycle:

- Expansion – This phase corresponds with strong job growth, increased demand for both homebuyers and renters, and an overall stable economy. Typically, investors will buy, build, and renovate properties since demand is high and inventory is lacking.

- Hyper supply – Also known as the oversupply phase, this stage begins when inventory exceeds demand. Demand decreases either because supply has finally caught up or a sudden shift in the economy leads to unemployment and borrowers can’t maintain mortgage payments. Sensing the next phase of a recession, nervous investors may feel inclined to sell off properties as vacancies rise and rent growth slows. For other investors, it’s an opportunity to implement a buy and hold strategy, adding to their portfolio with the intention to sell when the cycle returns to the expansion phase.

- Recession – At this point, the supply oversaturates the market as demand continues to fall. The result is high vacancy rates and negative rent growth. Investors who plan and save for this phase will have the opportunity to buy properties at foreclosure for cheap and hold them until the market swings back.

- Recovery – Identifying when this phase begins is difficult as many people will still be reeling from the recession phase. Recognizing when it starts depends on if you have a bleak outlook or wear rose-tinted glasses. Occupancy rates, new construction, and listing prices remain low. Foreclosures linger on the market. This phase is an opportune time to acquire property before home builders and homebuyers return during the expansion phase.

As we saw in 2008, the strength or weakness of the real estate market is a major driver for overall economic health. At the beginning of the pandemic, there was a sharp drop and then quick recovery estate professionals, buyers, and sellers adapted to the “new normal.”

Strategies to grow your portfolio today

Even though the U.S. saw the largest GDP growth in decades recently, economists have concerns that consumer spending and supply chain disruptions could hamper expansion. Home buyer and renter demand is high, but inventory isn’t keeping up. The natural consequence is inflation. Even distressed properties that typically offer a great return on investment are priced above what you might expect.

Smart strategies for real estate investing today may include:

- Buy-and-hold

- Multi-family

- Short-term rentals

- REITs

Buy-and-hold is a more conservative strategy to use as inflation drives up prices. Cash is king in a seller’s market. If you plan to finance and buy single-family homes, shore up your relationships with lenders and make competitive offers to shorten the inspection period.

To avoid competition with consumers, consider focusing on acquiring multi-family properties.

Short-term rentals in local tourist areas is another type of property to consider. The pandemic has changed how and where Americans vacation. Uncertainty about travel restrictions has tourists trading in their international itineraries for nearby destinations. Jeff Hurst of VRBO explains that domestic vacations also provide a “different kind of connectiveness to” places for younger generations.

If cash flow or financing a real estate transaction is a problem, REITs or Real Estate Investment Trusts provide another avenue to investing with little capital.

Keep an eye on the economic metrics that indicate when the market is entering a new phase and readjust your strategy accordingly.

These principles of macroeconomics act as a guide, not a rule. Remember to dive into the numbers of every specific property, local market, renter demographics, and consult your investment advisor before making a final decision.

Simplify Transactions with Blueprint

If you’ve been in the real estate investing game for a while, you know there are a lot of moving parts when it comes to getting the deal closed. Keeping track of whether your deal is on track can be difficult.

That’s where Blueprint can help. We’re modernizing the title and closing industry to build a better closing experience. Our in-house team of experts and proprietary technology are key to delivering on this. Our platform provides a greater level of transparency during the transaction process and makes our partners more confident that everything is running as it should be. Schedule a demo to see how.