The Four Phases of the Real Estate Cycle

- Amanda Farrell

- May 30, 2022

- 12:46 pm

- No Comments

Disclaimer: The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed. Blueprint makes no endorsements of any products, tools, or services mentioned.

Real estate is an asset that nearly every business needs. Even if every consumer shopped online, manufacturers and sellers require space to make and warehouse their goods, server sites for their data, and call centers for customer support.

In the residential space, single-family rental demand has been strong since the beginning of 2022 likely due to the lack of affordability for homebuyers. Rising interest rates, climbing listing prices, and fierce competition from migrating buyers with bigger budgets are hurdles to homeownership for many. The results are continued demand for rental properties of all types including single-family homes, townhouses, condos, and apartments.

Although there are risks with every investment asset, the ongoing need for real estate makes it an attractive one.

Seasoned real estate investors use historical knowledge to understand how the market is moving and make changes to their investment strategies. While no one has a crystal ball, understanding the phases of the real estate cycle is one way to potentially predict what might be on the horizon.

The Nuances of the Real Estate Market

Generally, the real estate cycle represents the overall macroeconomic and microeconomic status of the real estate market, but the real estate market is affected by many factors.

Location is usually the first consideration. One region may not reflect what the national averages show. For instance, in April 2022, home sales fell in the Northeast by 23%. In the Midwest, it was a decrease of 22%. However, in the South and West, sales increased by 10% and 3%, respectively.

Niches like single-family homes, apartment complexes, multi-family duplexes, triplexes, quadplexes, office buildings, storefronts, and other commercial properties may also experience vastly different rates of growth or decline in demand within the same time period.

Certain investment strategies like wholesaling, fix-and-flip, and buy-and-hold also make more sense under particular market conditions than others.

What are the characteristics of a recovery, recession, expansion, and hyper supply?

A few of the characteristics to gauge include:

- Whether it’s a seller’s or buyer’s market

- Vacancy Rates

- New Construction Rates

- Absorption Rates

- Rent Increases

These characteristics, plus other factors like interest rates, migration patterns, employment, wages, demographic shifts, and government intervention, can help you determine whether it’s a buy, hold, or sell environment.

What is the Real Estate Cycle?

Economists and analysts like Philip J. Anderson, have been tracing the history of real estate bubbles since 1800. In a human circadian rhythm, there is a natural cycle of rest and activity in a 24-hour period. Similarly, the real estate market experiences multi-year cycles of growth and decline. When left uninterrupted by government regulation, each cycle from 1800 to 1925 lasted a predictable or “natural” length of 18.6 years, averaging 14 years up and 4 years down.

Between 1925 to 1979, there were only two cycles, based on historical data, when there should have been three. During this time, the government responded to the Great Depression with regulations in hopes of mitigating the economic damage.

Within this timeframe, there was an extended 48-year cycle including the post-World War II economic prosperity ushering in the emergence of the American middle class. Homeownership rates boomed after World War II thanks to GI BIll’s effort to reintegrate soldiers back into civilian life with education and training, job placement, and home loans that required no money down.

A compressed cycle followed in the 1970s when the Federal Reserve doubled interest rates in 1979.

The Four Phases of the Real Estate Cycle

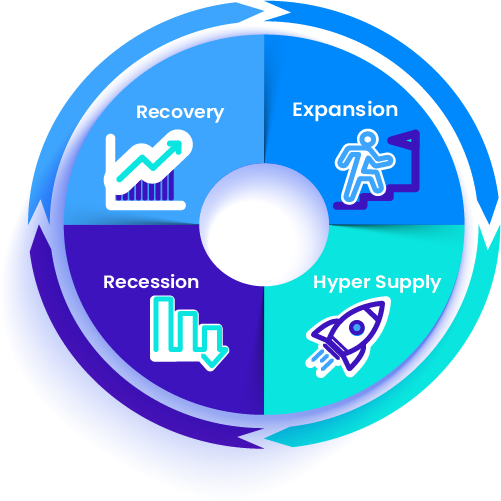

Regardless of length, the real estate cycle consists of four phases:

- Recovery

- Expansion

- Hyper supply

- Recession

What does Recovery Look Like in the Real Estate Cycle?

Still reeling from recession, this phase of the cycle is usually characterized by low consumer confidence, high unemployment, and a gloomy outlook on the economy. There may be a rash of foreclosures on the market, and builders are slow to start construction due to low vacancy rates.

This is usually a great time for investors to find a below-market value property in financial or physical distress to acquire. Anticipating the eventual expansion and demand for more housing, there’s a possibility to fix and flip or hold and rent as the property’s value grows.

Unfortunately, financing may be difficult to obtain as lenders and other investors may be skeptical about whether recovery has begun and if the net operating income will cover the debt. Investors may turn to private lenders or hard money loans as a result.

What is Real Estate Expansion?

This phase corresponds with strong job growth, increased demand from both homebuyers and renters, and an overall stable economy. The slowdown in construction creates more of an uneven distribution of supply and demand, and as occupancy rates increase, rent goes up too.

Many experts see this as an opportune time to invest in developing or redeveloping properties to meet buyers’ expectations and increase the desirability and price tag.

In addition to buying to renovate and sell, investors are likely to buy and hold single-family properties or purchase multifamily properties to cater to the demands of renters.

How does Hyper Supply Affect the Real Estate Market?

Also known as the oversupply phase, this stage begins when inventory exceeds demand. Demand decreases either because supply has finally caught up or a sudden shift in the economy leads to unemployment and borrowers can’t maintain mortgage payments. Sensing the next phase of a recession, nervous investors may feel inclined to sell off properties as vacancies rise and rent growth slows. For other investors, it’s an opportunity to implement a buy and hold strategy, adding to their portfolio to sell when the cycle returns to the expansion phase.

What Are the Characteristics of a Recession?

At this point, the supply oversaturates the market as demand continues to fall. The result is high vacancy rates and negative rent growth. Landlords may be forced to reduce their rental rates, decreasing their net operating income and potentially increasing their debt. As Jeremy Grantham stated on CNBC, “The first thing to go in a recession is the profit margin.”

Investors who plan and save for this phase will have the opportunity to buy properties at foreclosure for cheap and hold them until the market swings back. For those with the capital already available, they’ll likely find good deals on distressed properties.

How Investors Pivot their Strategy Based on Each Phase

Depending on your risk tolerance, financing options, and overall investing goals, certain phases of the real estate cycle may be more appealing to you than others. Before you make a decision on which phase is best suited for you, consider these additional details to help guide you:

- Location. Success in real estate is heavily dependent on knowing your backyard. If you’re new to an area, you may want to consider working with a knowledgeable real estate agent who can inform you on things like buyers’ tastes, what comparable properties are priced at, and which neighborhoods are growing in popularity.

- Property type. As the pandemic taught us, demand in residential and commercial properties doesn’t always track upward together. A record high of office space is hitting the market this year as demand for workspace decreases, while single-family homes continue to see sales price growth over last year. When supply tightens, owners gain the upper hand in setting rents and list prices. Buyers in certain areas may also prefer single-family homes over condos or vice versa. Understanding the tastes of local buyers and renters helps investors build and buy the right mix of property types for their portfolios.

- Financing. Access to capital, credit scores, and banking institutions’ appetite to lend may also influence when, where, and how you invest. For instance, traditional lending channels may not be available to you in a recession and you may need to seek out a private lender.

- Risk aversion. Timing is everything when investing. For those unsure of their ability to get it right, a buy-and-hold strategy may be a good option. When there is ample time to wait for returns, a buy-and-hold strategy is one of the ways investors can weather the ups and downs of multiple cycles as equity grows. However, other factors may negatively affect the overall returns.

- Goals. What are your goals in real estate investing? Retire early with a small investment portfolio with consistent returns? Build a multi-million dollar real estate empire with hundreds of doors? Fix-and-flip houses to increase the value and appeal of your local neighborhoods? Consider what drives your motivations and what matters most to you. As you continue to study the real estate cycle, it’ll be clearer to you which phase best suits your preferred strategy.

Closing with Blueprint During Every Phase

Blueprint works with real estate investors, lenders, and other professionals. Within our title and closing platform, users can submit, track, and close transactions without sifting through email chains or calling to check in. Blueprint’s API allows for new transaction submissions, pulls information about in-progress deals, and pushes real-time updates when there’s a change in status, giving you the power to manage all your transaction data in one place. When it’s time to close, you can schedule convenient remote online notarization or mobile loan signing appointments, where available.

Learn more about how Blueprint empowers investors, and schedule a demo.