How to Invest in Real Estate with Little or No Money

Disclaimer: The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.

- Amanda Farrell

- April 15, 2022

- 1:20 am

- No Comments

Most people think that it takes money to make money, especially in real estate investing. Between high home prices, rising interest rates, required down payments, and closing costs, the price tag amounts to an intimidating total. As Americans grapple with housing affordability concerns, the dream of homeownership seems less realistic.

The idea of investing in real estate when you can’t even afford to buy your first home sounds absurd, but investors are finding creative ways to make money with real estate even without a large number in their bank accounts.

Three Ways To Make Money In Real Estate Without Much Capital

- Wholesaling

- Real Estate Investment Trust (REIT)

- Fractional investing

What Is Real Estate Wholesaling?

Despite the use of the term wholesaling in retail, real estate wholesaling doesn’t involve the sale of multiple properties at a reduced price. Instead, a real estate wholesaler finds homes that are off the market, contracts with the owner to sell the property, and then assigns the contract to a buyer.

Wholesalers usually don’t need a license like real estate agents because they are selling the contract and not the property itself. The homes a wholesaler targets are usually distressed properties that either need repairs or have a title issue, which makes the property less appealing to an average homebuyer. However, the properties may appeal to certain investors like house flippers at the right price.

Unlike house flipping, wholesalers don’t make any repairs before selling the contract. The bulk of a wholesaler’s work consists of networking with investors and finding the right buyer, as well as marketing to would-be sellers and negotiating a reasonable price.

Already have a deal in the works? See how Blueprint makes the transaction easy for investors and their counter-parties. Get a demo.

How Do Wholesalers Make Money?

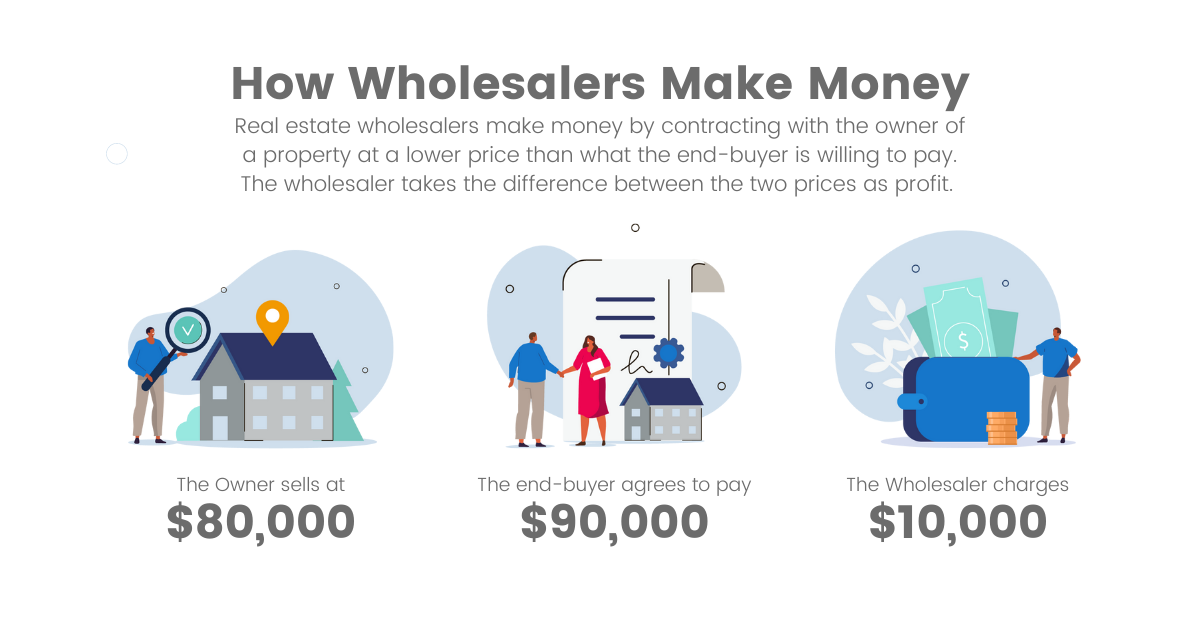

Real estate wholesalers make money by contracting with the owner at a lower price than what the end-buyer is willing to pay. The wholesaler takes the difference between the two prices as profit.

For example, if the wholesaler finds a property owner willing to sell at $80,000 and a buyer willing to purchase that property at $90,000, the wholesaler charges $10,000 for coordinating the deal between the two parties.

The Pros and Cons of Wholesaling

While wholesaling is a great way to get your foot in the door of real estate investing, there can be a steep learning curve. There are a few clear benefits to starting with wholesaling, but you need to be aware of some of the challenges.

Here are some pros and cons to consider.

Pros: Since you aren’t purchasing the property, this is one of the best short-term strategies in real estate with little capital required upfront. It’s far less risky than house flipping because you never take possession of the property. There are no monthly costs like a mortgage, property taxes, or insurance.

Depending on the market and your connections, you could turn around a contract from a seller to a buyer quickly.

Cons: While a straightforward concept, it’s a lot of work and requires contract knowledge. Adding a contingency to the contract you sign with the seller will protect you from financial risks if you aren’t able to find a buyer before the closing date. If you’re continuously unable to deliver under the terms of your contract, there may be legal ramifications.

There’s typically a lower profit margin than with other types of real estate investing, but it’s relative to the lower financial risks.

Juggling both sides of the transaction proves to be one of the most difficult aspects of wholesaling. Lining up one great purchase after another without a potential buyer in mind is one of the most common mistakes. If you lack networking skills to deepen your investor pool, wholesaling might not be right for you.

Income with this strategy can be sporadic as it requires matching the right buyer with the right seller. You’ll also need to find the right title partner to help you complete the transaction. However, many title agencies are designed to cater to the average homebuyer and not investors. Blueprint’s approach to title and closing is built around the unique needs of real estate entrepreneurs. Learn more about how we empower investors.

What Is a Real Estate Investment Trust (REIT)?

A Real Estate Investment Trust (REIT) is a tax-advantaged company that purchases, manages, or finances income-producing real estate. Like a mutual fund, the company pools the money from multiple investors.

This type of company was created by the federal government under the REIT Act to make real estate investing easier for more people. It helps fund infrastructure and commercial real estate projects that are in high demand without increasing taxes. REIT companies got a sweet IRS deal too; no corporate income tax as long as they payout 90% of their income as dividends.

At least 75% of a REIT’s assets must be real estate. While a REIT portfolio is usually mostly comprised of commercial real estate, the types of property you’ll find include:

- Single-family homes

- Apartment complexes

- Data centers

- Office buildings

- Shopping malls

- Warehouses

- Hotels

- Cell towers

- Airports

- Toll roads

How Do You Make Money with a REIT?

REITs pay out those dividends to their shareholders after operating expenses are deducted every quarter. Before you put your money into a REIT, it’s important to understand the types of strategies it implements.

Three Basic Investing Strategies of REITs

- Equity REITs generate revenue by buying and holding rental properties. You reap the benefits of being a landlord without having to worry about the daily management of tenants.

- Mortgage REITs (also known as mREITs) generate revenue by either financing mortgages for others directly or by investing in mortgage-backed securities.

- Hybrid REITs combine both investment strategies.

The Pros and Cons of REITs

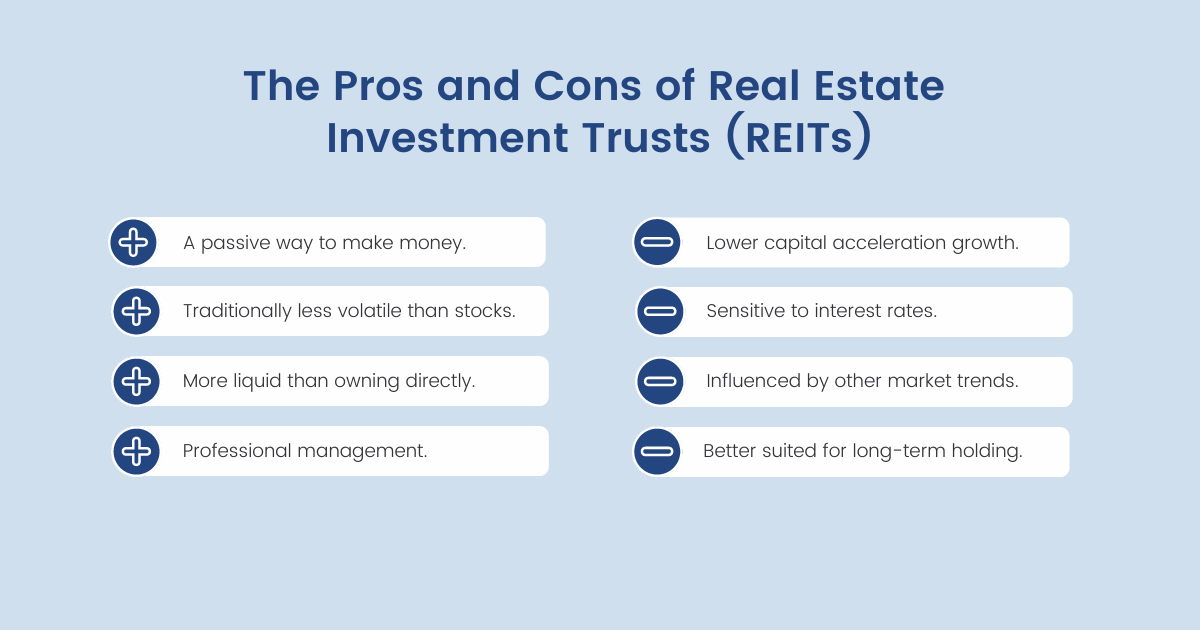

As with any investment, there’s a risk of loss. Be sure to do your research, talk to a financial advisor, and weigh the pros and cons. Here are a few of the benefits and downsides to consider with REITs.

Pros: It’s a passive way to make money from real estate without the major upfront costs like a down payment and continuing maintenance costs.

REITs are traditionally less volatile than buying stocks. While real estate isn’t as exciting as investing in the next big thing, it’s stable. Generally, real estate is known to generate more resilient cash flow.

Because REITs are stable and usually impacted by different factors from most stocks, they help strengthen and diversify portfolios.

REITs are also easy to buy and sell, making them more liquid than owning a real estate asset directly.

You also won’t have to deal with problematic tenants, evictions, or any of the other troubles that come with being a landlord.

Cons: While stable, building wealth with a REIT is gradual. Despite the total return of REITs outperforming the S&P 500 Index for the last 20 years, capital appreciation is hindered by the requirement to pay out such a large percentage of its profit whereas other corporations might reinvest that money to accelerate growth.

Because REITs often finance their properties, they come with a high debt load. Be sure to understand how the company is managing that debt to ensure it can pay out a worthwhile dividend.

Not all REITs are registered with the U.S. Security and Exchange Commission (SEC). The SEC recommends investors do their due diligence before purchasing. You can verify registration on the SEC’s EDGAR system. Here, you can also review and analyze a REIT’s annual and quarterly reports and prospectus.

Certain market factors like rising interest rates and high purchase prices can affect the short-term and long-term value of a REIT, so be sure to consider how proposed interest rate hikes, demand, and prices may impact your investment.

What Is Fractional Investing?

In stock lingo, fractional investing is when you purchase a portion or a fraction of a share instead of the entirety. When applied to real estate, fractional investing allows you to own a portion of a property, a real estate portfolio, or a mortgage loan.

Not to be confused with fractional ownership or what your grandparents might call a timeshare, this modern approach to real estate investing serves as the basis for multiple startups.

How Do You Make Money with Fractional Investing?

Also referred to as real estate crowdfunding platforms, the most popular include Arrived Homes, Fundrise, and Groundfloor. Each company takes a common real estate investing strategy and makes it easier for anyone to take a small sum of money and stake a claim in real estate.

With Arrived Homes, you can buy a portion of a rental property for as low as $100. Instead of focusing on large commercial properties like a REIT might, this platform buys single-family homes that are more affordable. Once the pre-selected property management team is in place and rents are collected, investors earn a share of profits based on the number of shares purchased.

Fundrise takes your starting investment of just $10 and automatically spreads it across multiple projects to maximize returns based on your selection of four curated categories. These categories reflect the investor’s risk aversion and projected annual dividend. Starting from the lowest on the risk/reward scale, the categories include Fixed Income, Core Plus, Value Add, and Opportunistic.

Like Arrived Homes, Fundrise is meant to be thought of as a long-term investment with longer hold periods.

Groundfloor is similar to a mortgage REIT with a lower barrier to entry. The company offers short-term funding to developers and flippers to help them finish renovation projects. Retail investors can purchase a portion of a loan for as little as $10. Groundfloor analyzes the risks of each loan and grades them from A to G. After the loan is paid off, distributions are issued to the investors.

The Pros and Cons of Fractional Investing

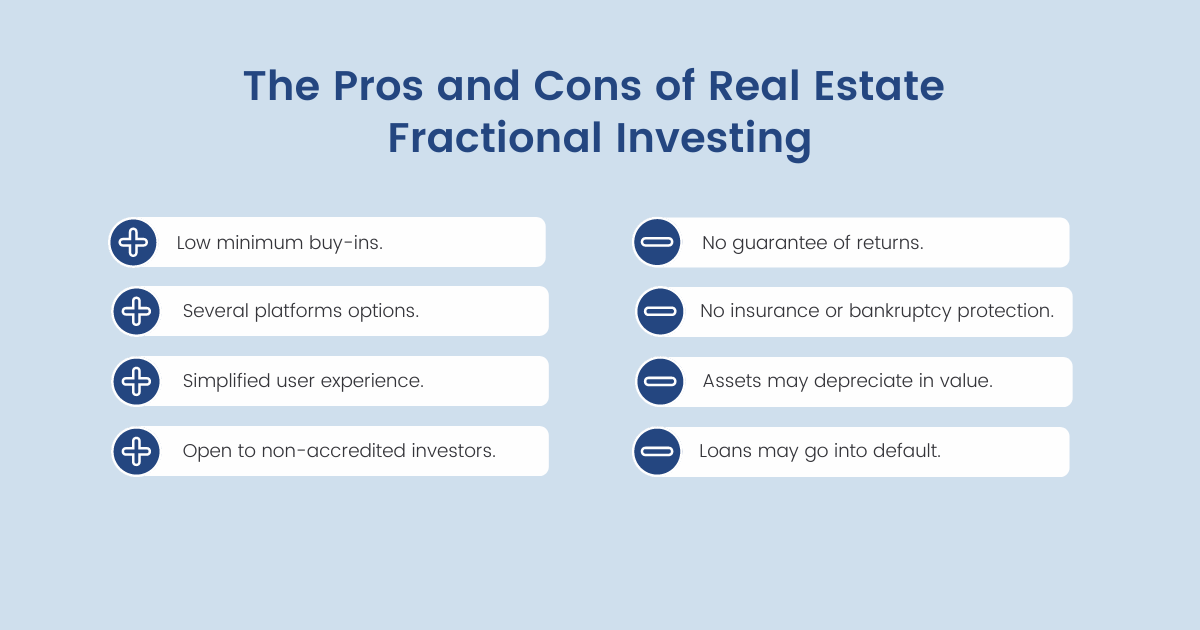

Easier doesn’t mean safer. While it’s simple to get on these platforms and start investing, risks still remain. Before you try fractional investing in real estate, but sure to think about these pros and cons and talk with a financial advisor.

Pros: All of these options are open to non-accredited investors with little capital, so it’s a great way to start. With Fundrise and Arrived Homes, you don’t have to worry about actively maintaining a rental property on your own.

If you prefer more control and short-term yields, Groundfloor might be the better option.

Cons: Like with stock investments, there’s no guarantee that your investment will produce a return. There’s no insurance or bankruptcy protection should the homes depreciate in value, rents go unpaid, or the loans go into default.

Read more about the specific pros and cons of Arrived Homes, Fundrise, and Groundfloor before forking over your hard-earned money.

With $100 or less it’s possible to make real estate investing work for you, but one of these methods to make money might work better for you than the others. Take a deeper dive into the one that interests you before jumping in headfirst. With the right education, you can feel confident in your choice and insulate yourself from unforeseen risks.