The Top-Ranked Real Estate Markets for Investors

Disclaimer: The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.

- Amanda Farrell

- February 1, 2023

- 12:33 pm

- No Comments

Adaptability and diversification are vital portfolio traits as markets shift downward from the hyperspeed rent price growth and home price appreciation of the past two years to a more typical pace. Despite a national slowdown, specific markets still show signs of a solid real estate market for investors. Opportunities for active investors are plentiful, but capitalizing on them will likely require examining new markets and adjusting strategies accordingly.

Data analysis from Zillow, PwC, Redfin, Realtor.com, and other real estate experts suggest these markets may be worth a look.

According to CBRE’s U.S. Investor Intentions Survey, we can expect less investing activity in 2023 compared to 2022 because of rising interest rates, recession concerns, and constraints on credit availability. In the face of these challenges, nearly half of the respondents (45%) report potential price adjustments as their main reason for increasing real estate allocation. Despite the overall economic uncertainty, investors seem cautiously optimistic about opportunities in the Sunbelt, high-performing secondary markets, and overlooked contenders in the Rust Belt.

Here are a few markets on top-ranked lists for 2023:

- Nashville

- Austin

- Raleigh-Durham

- Charlotte

- Dallas-Fort Worth-Arlington

- Atlanta

- Tampa-St.Petersburg

- Miami

- Pittsburgh

- Cleveland

Related Reading: What Makes a Good Market for Real Estate Investors?

The Future Looks Bright for These Supernovas

Three cities in the Sunbelt are projected to have such bright futures that PWC’s report, Emerging Trends in Real Estate 2023, has dubbed them “Supernovas.” The moniker reflects the meteoric rise of these markets over their peers with massive and sustained population growth over the last decade. They include Nashville, Austin, and Raleigh-Durham.

Nashville, Tennessee

Nashville and its surrounding area are home to over 2 million residents and 50,000 businesses. With nearly 25,000 employees, Vanderbilt University Medical Center is the largest employer. Other notable employers with a large workforce include Nissan, Vanderbilt University, Amazon.com, General Motors, and Randstad, the staffing agency.

Nashville residents are also known for supporting entrepreneurial endeavors, with over 20,000 small businesses registered in Davidson County. This business activity is a magnet for workers across the country and results in an unemployment rate below the national average.

Additionally, millions of tourists are drawn to Nashville every year to experience the sounds of Music City. Tourism experts anticipate 15 million visitors in 2023. In 2022, there were 14.4 million, an increase of 13% over 2021.

Whether catering to the demands of homebuyers, renters, or tourists, investors are likely to find opportunities to build their portfolio in Nashville. The appreciation rate for the area was among the highest in the nation at 25.15% for a 12-month period between the first quarter of 2021 and 2022, according to Norada Real Estate Investments. Since 2000, prices have risen by 160.71%.

What makes Nashville an attractive market for investors?

- Median Sale Price: $445,000

- Days on Market: 53

- Price Appreciation: +8.5% year-over-year

- Average Rent: $1,819/month

- Population Growth: +1.62%

- Unemployment Rate: 2.3%

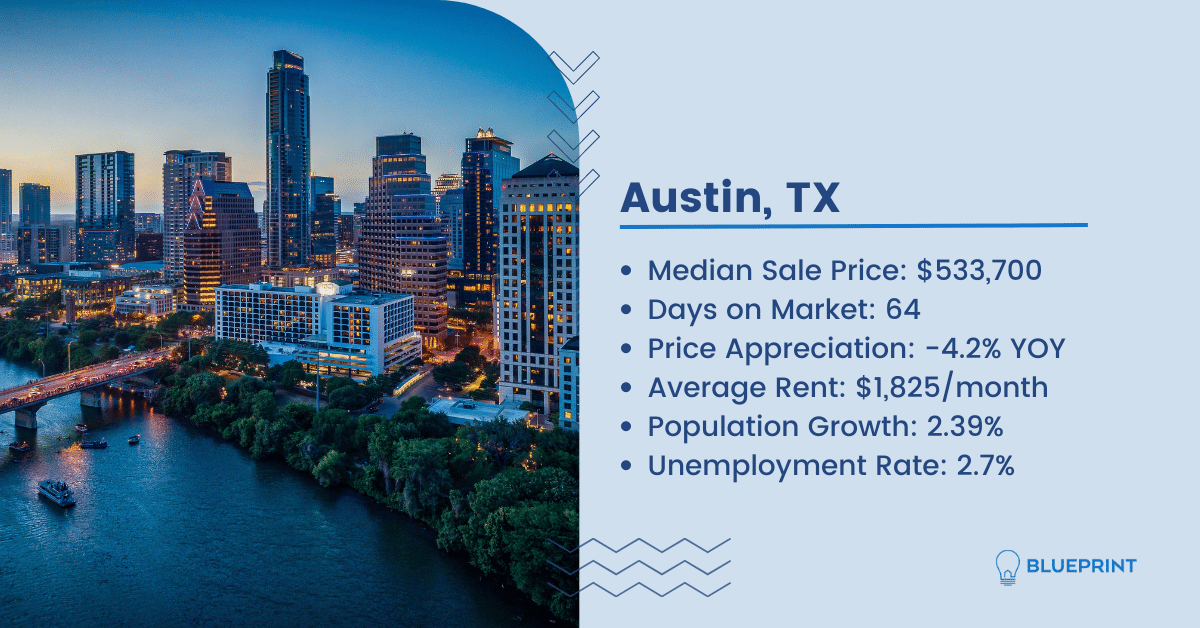

Austin, Texas

The next Supernova on PwC’s list is Austin. Last year, the city placed tenth on Zillow’s report, but it’s fallen off the 2023 list and crept down Realtor.com’s Top Housing Markets for 2023 to number 80.

Despite its mixed reviews, Austin’s economy is still growing, and experts say a pending recession is unlikely to shake it. The stability of its economy and an above-average level of white-collar employment appeals to real estate investors looking for sustained population and job growth. Still, concerns linger about how affordability will impact future migration and job opportunities, especially in low-wage service industry jobs.

Rent increases are desirable for landlords, but Austin rents nearly doubled in one year, making it the fifth most expensive large city for renters. During that same time, Austin became a “Millennial magnet” as 24,000 moved in. The high-paying tech jobs are one of the biggest reasons for this demographic to flock to the region. Major employers include Amazon, Apple, Dell Technologies, and IBM, each employing over 6,000 workers.

Elon Musk also recently moved his Tesla headquarters from California to Austin to take advantage of Texas’s business-friendly environment. His SpaceX project is constructing a half-million-square-foot building in Bastrop, 30 miles outside of Austin.

Like other Supernovas on the list, the imbalance of demand and supply pushes living costs to unmanageable heights for many residents. Boise faced a similar meteoric rise and sharp fall last year. Whether Austin will become another Icarus or push past these growing pains is yet to be determined. Investors may want to wait since Goldman Sachs predicts prices to dive by more than 25% in 2023 compared to 2022 peaks. The decline isn’t expected to trigger a widespread credit crisis among homeowners, but those who purchased in late 2021 and early 2022 may soon be underwater.

What makes Austin an attractive market for investors?

Raleigh-Durham-Chapel Hill, North Carolina

The last Supernova we’re spotlighting is Raleigh-Durham-Chapel Hill. Like Austin, it’s fallen out of the top 20 on several lists, but ranked #6 on PwC’s Markets to Watch report.

In the second quarter of 2022, sellers in the Raleigh-Durham-Chapel Hill area, known as “The Triangle,” reaped record-breaking profits. The typical gain was about $167,750 or a profit margin of 64.3%. The average quarterly profit margin for home sales is 15.6%. Overall, the year ended strong for Raleigh, ranking second for the largest median-price increase (up 17.9%) for a market of its size, according to ATTOM US Home Sales Report. Tampa, FL, took the top spot with an increase of 21.9%.

Small, out-of-state real estate investors or “laptop landlords” increased their purchasing activity during this time and took a particular interest in Raleigh, Durham, and Charlotte.

Like other markets, the Triangle is experiencing price adjustments as the Fed raises interest rates. However, real estate agents in the area are still confident the foundational growth metrics underpin a favorable outlook for investors.

The population grew 23% in the last decade, with in-migration accounting for two-thirds. Rent price growth is up 10.2% year-over-year. Top-tier universities in the surrounding areas supply a steady stream of student residents and faculty. Despite the soaring costs to rent or buy, residents make for competitive candidates as a large percentage of those working in high-paying research, tech, and government jobs have credit scores of 700 or higher, access to 20% down payments, and secure a mortgage before looking for a home.

What makes Raleigh-Durham-Chapel Hill an attractive market for investors?

- Median Sale Price: Raleigh-Durham $380,000; Chapel Hill $510,00

- Days on Market: 49; 47

- Price Appreciation: -1.3% year-over-year; + 7.4% year-over-year

- Average Rent: $1,630/month; $1,917/month

- Population Growth: +2.84%

- Unemployment Rate: 2.8%

Investors Find a Sunny Forecast in the South

Dubbed “Super Sun Belt” markets, these metropolitan areas are large and diverse but still affordable, forming powerhouse economies that attract a wide range of businesses. Despite their large population bases, Super Sun Belt cities are among the fastest-growing markets in the U.S. Economic performance has been solid as the recovery has been much quicker and more complete.

Charlotte, North Carolina

Last year, Charlotte debuted on Realtor.com’s list of the nation’s hottest markets for 2022 at number 15 and ranked number 5 in Zillow’s analysis. This year, the Queen City reigns at the top of Zillow’s list.

Known for its bustling downtown after business hours, the “18-hour city” continues to attract new businesses with its favorable corporate tax environment. It’s now home to more than 10 Fortune 1000 companies. With Bank of America and Wells Fargo among its largest employers, Charlotte has become the nation’s second-largest financial industry city after New York. According to Mynd, cities with healthy financial markets make strong real estate markets because banks can weather the storm of rising rates and high inflation.

The region’s technology sector is also growing as fintech follows bankers’ migration. Between 2016 and 2020, the tech talent pool grew by almost a third. Employees in both industries tend to be Millennials and Gen Z and are more likely to rent. Despite recent rises in the cost of living, Charlotte offers these junior bankers and other workers a big city lifestyle at a fraction of the price with a good airport, NBA and NFL teams, international cuisines, and museums.

What makes Charlotte an attractive market for investors?

- Median Sale Price: $391,000

- Days on Market: 48

- Price Appreciation: +7.1% year-over-year

- Average Rent: $1,667/month

- Population Growth: +2.86%

- Unemployment Rate: 3.1%

Dallas-Fort Worth-Arlington, Texas

Considered the largest metro area in the state of Texas, Dallas-Fort Worth-Arlington has plenty of room to host employers like AT&T, Southwest Airlines, Walmart, and American Airlines. Like Charlotte, the Dallas area has experienced an influx of tech workers. Dallas-Fort Worth is reported to have the state’s largest segment of the tech workforce, with 313,447 employees.

Zillow predicts it’ll be the fourth hottest housing market in 2023.

Both Austin and Dallas saw astronomical price growth during the pandemic, which gave sellers an upper hand, but now the tables have turned in favor of buyers. Recent price drops in Dallas indicate a market correction and a return to typical real estate activity seasonality, not a crash, one expert tells Axios.

Despite slowdowns, short-term and long-term home value predictions suggest Dallas is a good place for real estate investors. Texas towns are an attractive spot for landlords with no state income tax and no state capital gains tax on the income from property sales. The lower price point of Dallas houses compared to other major cities provides a bigger boost in returns. Renters and homebuyers are attracted to the DFW area for various reasons, including its growing job market, big-city buzz, quaint suburbs, digital infrastructure, and high quality of life at an affordable cost.

What makes Dallas-Fort Worth an attractive market for investors?

- Median Sale Price: Dallas $345,000; Fort Worth $343,000

- Days on Market: 37; 48

- Price Appreciation: -11.5%; +4.0%

- Average Rent: $1,598/month

- Population Growth: +1.33%

- Unemployment Rate: 3.2%

Atlanta, Georgia

If Austin is the Silicon Valley of the south, Atlanta is the Hollywood. Film production in the region is driving increased numbers of full-time and part-time residents working in the entertainment industry. Tyler Perry works and lives in Atlanta with his studio in the heart of the city and a recently completed 100-million mansion in the Douglasville suburb.

Long before the studios and starlets, Atlanta has been a mecca for burgeoning hip-hop artists and musicians. Other famous residents include Jeff Foxworthy, Ludacris, Steve Harvey, Chris Tucker, Elton John, and Gladys Knight.

Don’t let the entertainment industry steal the limelight in Atlanta’s diverse and thriving job market. Other industry sectors include bioscience, fintech, technology, supply chain, and advanced manufacturing. Seventeen Fortune 500 companies are headquartered here, including Coca-Cola, Delta Airlines, The Home Depot, and United Parcel Service (UPS).

The tide is turning on who will make concessions in several highly desirable markets, including Atlanta. Data from Redfin shows the Atlanta metro area has the 8th largest share of home sales with concessions in the last quarter of 2022. Investors will likely benefit from such a sea change as sellers are less likely to require risky terms like waiving financing and inspection contingencies and perhaps even entertain an offer under the list price.

What makes Atlanta an attractive market for investors?

- Median Sale Price: $390,000

- Days on Market: 40

- Price Appreciation: +1.6% year-over-year

- Average Rent: $1,880/month

- Population Growth: +1.55%

- Unemployment Rate: 2.6%

Tampa-St. Petersburg, Florida

Between April 2020 and April 2021, approximately 903 people moved to Florida daily, totaling almost 330,000. Many wealthy transplants originated from the Northeast and Chicago to take advantage of the warmer weather, lower taxes, relaxed covid restrictions, and relatively lower home prices. Even before the mass pandemic migration to Florida, people of diverse backgrounds were flocking to the Sunshine State. Two-thirds of residents weren’t born in the state, and one in five was born in another country.

For many, Tampa is the place they call home now. With a beautiful gulf coast, major sports teams, museums, and a thriving arts and culture scene, it’s no surprise that Forbes ranks Tampa as the best city to live in the state.

Creating high-quality jobs in finance and professional services helped Tampa stay afloat during the pandemic recovery. Several headquarters of Fortune 500 companies are located in Tampa, including Publix Supermarkets, Tech Data Corp, WellCare Health Plans, Raymond James Financial, and casual dining company Bloomin’ Brands, which owns Outback Steakhouse and Bonefish Grill.

Tech talent in the area is growing too. Between 2016-2020, it was in the top US markets for growth in the industry, with a “brain gain” of 23.5%. Waterfront dining, shopping, and entertainment attract younger workers, a cohort prime for first-time homeownership or single-family rentals.

Tampa is a magnet for homebuyer migration. Despite the hike in listing prices during the pandemic, it’s the cheapest city on the list of metros popular with relocating homebuyers and less expensive than the national median average. The current level of construction is 15.4% above the long-term average, according to a report from the National Association of Realtors. Although there’s plenty of land for development to meet the demand in surrounding suburban areas, much of the rapid construction in the last few years have been concentrated in established, desirable neighborhoods in South Tampa.

What makes Tampa-St. Petersburg an attractive market for investors?

- Median Sale Price: $376,000

- Days on Market: 34

- Price Appreciation: +10.9% year-over-year

- Average Rent: $1,917/month

- Population Growth: +1.09%

- Unemployment Rate: 2.2%

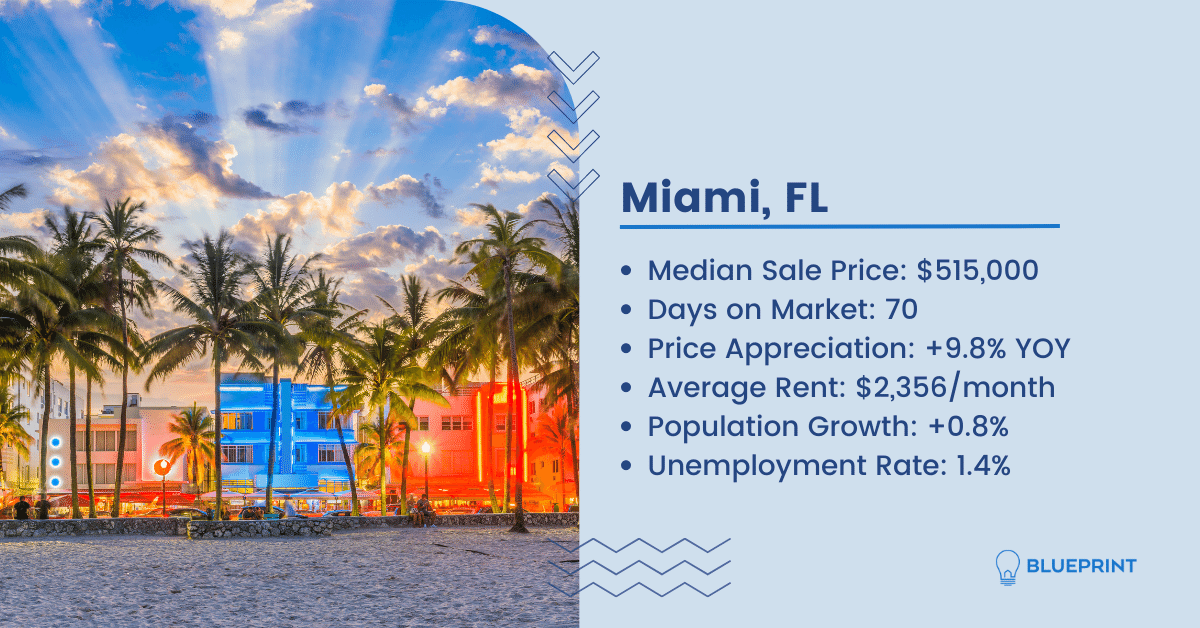

Miami, Florida

Miami also ranks highly among incoming homebuyers, but it comes with a much higher price tag of slightly over half a million. Despite that, many are drawn to the vibrant city with its Caribbean and Latin American influences, art deco architecture, and robust job market expanding several diverse sectors like aviation, healthcare, and hospitality.

Like others on this list, Miami is experiencing an influx of tech industry workers. Miami is an odd choice for a tech hub with no top-tier engineering schools and few well-known technology companies. Still, disenchanted Silicon Valley entrepreneurs are encouraging others to move to the city. Under the influence of crypto-evangelists and wealthy foreign investors, it’s become the epicenter of cryptocurrency real estate transactions. The first Bitcoin-to-Bitcoin transaction of a condo was completed in Miami in 2017 for 17.74 bitcoin, or the equivalent of $275,000.

In 2022, buyers from another country accounted for $6.8 billion in real estate sales, a 34% increase from 2021. Foreign investors from Argentina, Colombia, and Canada made up 66% of all-cash buyers.

Unlike others on this list, Miami is expected to weather the storm of a housing market correction. A revised housing market forecast from Goldman Sachs predicts that the city will experience a slight increase in home prices in 2023, while Austin and Tampa will likely see decreases of -15.6% and -11.2%, respectively.

What makes Miami an attractive market for investors?

- Median Sale Price: $515,000

- Days on Market: 70

- Price Appreciation: +9.8% year-over-year

- Average Rent: $2,356/month

- Population Growth: +0.8%

- Unemployment Rate: 1.4%

Revived Real Estate Markets in the Rust Belt

In early 2022, Redfin’s Chief Economist, Daryl Fairweather, predicted that soaring home prices in the Sun Belt would push homebuyers to the more affordable Rust Belt cities like Columbus, OH, Harrisburg, PA, and Indianapolis. During that time, most came from the Northeast, Midwest, and West Coast, but there’s still time for the prediction to unfold as buyers can find affordable homes with steady price appreciation. In real estate, missing out on trends like the explosive price appreciation in the Sun Belt can bode well for long-term investors. The Rust Belt dominated Insider’s list of cities that will remain resilient through a recession.

Pittsburgh, Pennsylvania

Coming in at number 15 on Realtor’s 2023 Housing Forecast list and number three on Zillow’s, Pittsburgh has a lot to offer residents. Despite its cold moniker, Steel City has a warm and welcoming atmosphere, and the amenities are popular among people looking to relocate. There’s access to waterways, green spaces, major sports teams, a thriving food scene, plenty of arts and cultural events, and a theme park.

When Pittsburgh was founded, coal mining, timber, and steel production made up the backbone of its economy. By the 1970s, these industries waned, and Pittsburgh’s economy and job market suffered. Since then, the city has become home to a more diverse scope of industries, including healthcare, education, state government, finance, automotive, professional services, and technology.

Major employers include the University of Pittsburgh Medical Center, Highmark Health, PNC Bank, the University of Pittsburgh, Carnegie Mellon University, and Amazon.

A housing affordability report from Nerdwallet showed that average list prices are 2.9 times first-time homebuyer income, making it the most affordable city, followed by Cleveland, OH, at 3.3.

There’s a strong renters’ market in Pittsburgh, too, with 50% of units occupied by renters and a 6% year-over-year increase in rents. A good proportion of rental inventory consists of single-family homes, making up 74% of the total units.

What makes Pittsburgh an attractive market for investors?

- Median Sale Price: $225,000

- Days on Market: 63

- Price Appreciation: +2.3% year-over-year

- Average Rent: $1,462/month

- Population Growth: +0.18%

- Unemployment Rate: 3.7%

Cleveland, Ohio

The Rock & Roll Hall of Fame is probably Cleveland’s most well-known landmark, but there’s a lot more to do in the city. Residents and tourists visit the city center to enjoy meals prepared by award-winning chefs, view art at the Museum of Contemporary Art Cleveland, find serenity at the Botanical Garden, watch a game, or indulge in the nightlife at countless bars and restaurants.

Like Pittsburgh, Cleveland was a hotbed for heavy industries like steel, but the city’s economy has become more diverse in recent years. Among the many small, family-owned businesses, Cleveland is the headquarters for five Fortune 1000 companies. Today, major employers include Cleveland Clinic, University Hospitals, the US Office of Personnel Management, and Sherwin Williams. The startup industry is also strong, with a recent influx of $578 million from venture capitalists.

Cleveland has the lowest median price of any city on this list at $115,000. Cleveland presents a favorable solution as more markets hit the ceiling where the return on investment and cash flow generation shrinks (or disappears). The median asking price per square foot is only $77, and homes are selling for 2% less than their asking price on average, according to Norada. Out-of-state investors can make their capital stretch further despite the rise of interest rates.

What makes Cleveland an attractive market for investors?

- Median Sale Price: $115,000

- Days on Market: 38

- Price Appreciation: +4.5% year-over-year

- Average Rent: $1,316/month

- Population Growth: +0.17%

- Unemployment Rate: 3.5%

A Transparent Closing Experience No Matter the Market

If you’re eyeing one of these markets for your next single-family residential or small multi-family investment, Blueprint can help make your closing experience smoother. Our team of title and escrow professionals have experience in markets across the country and understand investors’ unique transaction needs and challenges. Non-traditional transactions are no problem, whether you’re leveraging contract assignments, double closes, transactional funding, novations, or other methods to fund and close your deals.

Whether you’re doing one or 100 transactions, placing and tracking your title orders is easy with the Blueprint platform. Get insights on what’s happening with the Status Tracker, find support, and upload, download, and electronically sign documents in one place.

Want to learn more? Request a demo!

Sources: Redfin Housing Market Report as of February 1, 2023, Rentcafe.com, Matrotrends.com, and Bureau of Labor Statistics, as of December 2022