Blueprint

Using the Blueprint Platform: Submitting Your Transactions

As a Blueprint partner, we want you to be able to scale in whatever way makes sense for your business. To that end, we strive to allow you to run as many transactions as you want without barriers.

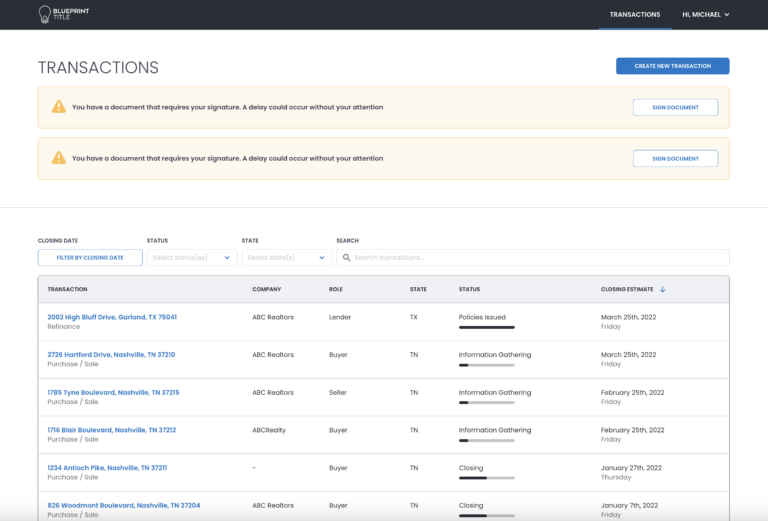

The Blueprint Portal is built with that goal in mind. We build every feature to optimize for multiple transactions. In doing so, we give our partners the opportunity to see their full list of transactions, the closing stage for each one, and to easily move through tasks such as uploading documents and e-signing.

One of the most important elements for scaling your investments is the ability to sign a contract and get to closing as soon as possible. To make this easy, we’ve built transaction submission right into the Portal.

Where to Submit a Transaction

Rather than calling in or emailing a new transaction to us, the Portal gives you the ability to open a file with quick information, a few clicks, and uploading key documents.

To start a new transaction, log into the Portal. During onboarding, you and your team were given access to the Portal. If you have trouble logging in, please reach out and we will troubleshoot the issue to get you back up and running.

Once you’ve logged in, you’ll see a blue “Create New Transaction” button in the top right corner of the window. Click that button and you’ll be into the transaction submission process.

Subscribe for for more information on Blueprint Academy content, events, community initiatives, and more.

By clicking Subscribe Now!, you agree to receive Academy Newsletter emails from Blueprint. You also agree to our privacy policy and terms of use. You can update your subscription preferences at any time by clicking the unsubscribe link in our emails.

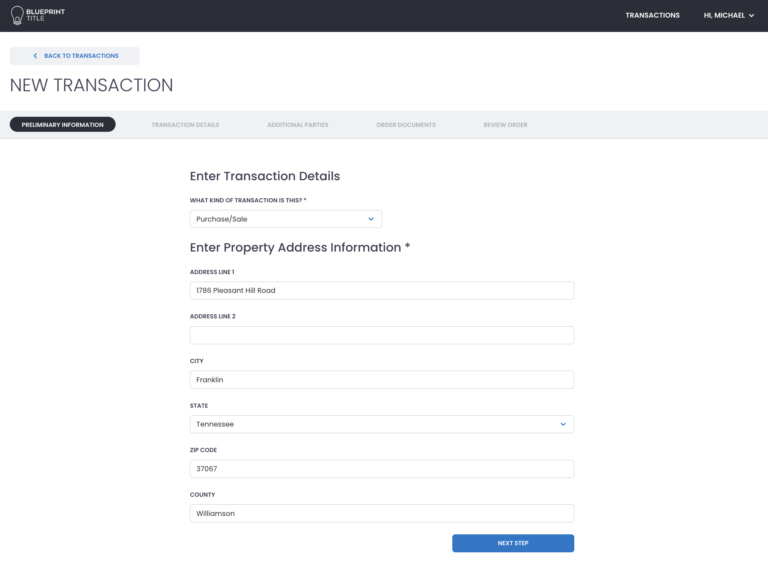

Step 1: Preliminary Details

The first step in the process is to enter preliminary information. You’ll select the type of transaction, whether purchase or refinance. This allows us to orient the closing process. If the transaction is a refinance, you will be asked for the loan amount.

Finally, you will provide the property address so that we can make sure we are searching against the correct property. This form is very much like any other address form you fill out, asking for street address, city, state, zip code, and county. As you fill in the address, you will see the option to autocomplete through an integration with Google Maps. You can select the autocomplete or use manual entry. Manual entry can be especially helpful when multiple parcels are involved.

While the property description may be contained in other documents that you will submit, having this information in the system at the time of submission will help us get started faster, cutting down on the time for someone to look through the document for important information.

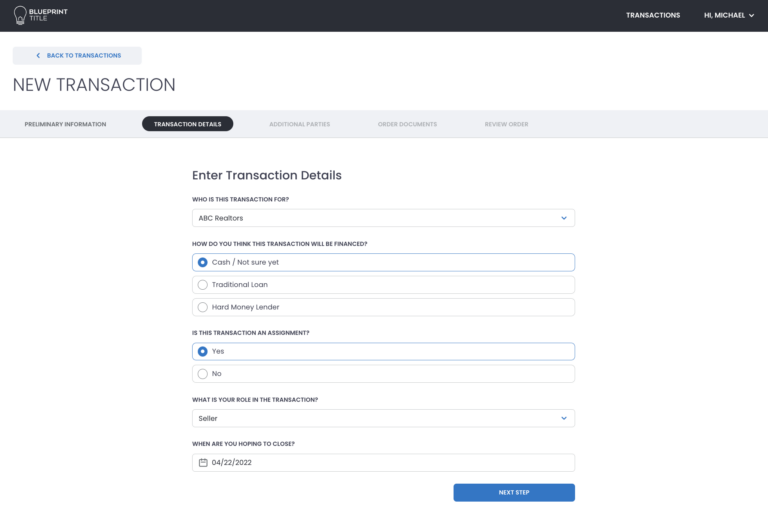

Step 2: Transaction Details

From there, you will move on to transaction details. The first box asks for the name of the party opening the file. While this will typically be you or your company, we want to make room for the idea that each user may have multiple entities or partners, depending on how you structure your business. There will be additional questions, such as how the transaction will be financed and whether the transaction is an assignment or a double close, or traditional residential purchase/sale.

You’ll also select your role in the transaction from a list, which includes buyer, seller, buyer’s agent, and seller’s agent. This helps us know your side of the transaction and what counterparties we can expect.

Finally, you can select a date that you would like to close. While we cannot guarantee that closing will happen on your selected date, this does allow us to set a level of priority for the transaction in order to expedite the process where possible.

Depending on the transaction, you may be asked for additional details, such as rate lock dates, loan processor, or loan officer for refinance transactions.

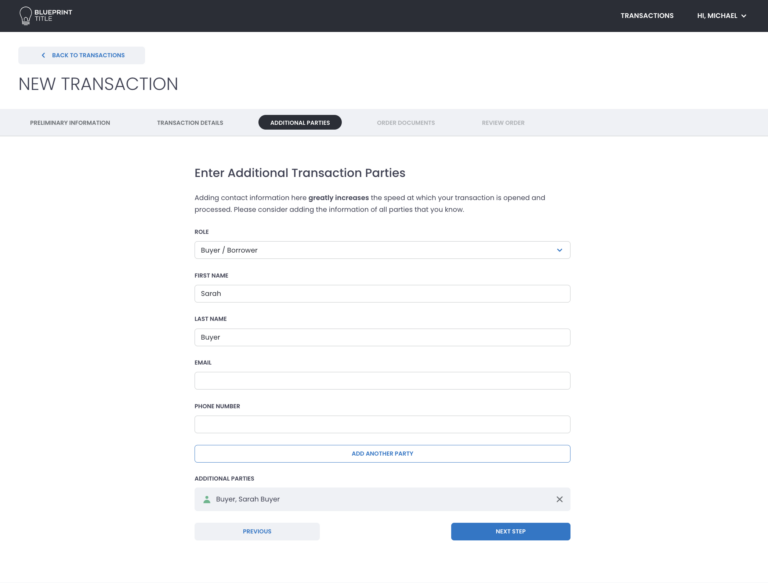

Step 3: Additional Parties

This is where you will enter additional party information, whether for co-parties or counterparties. It’s extremely helpful to us for you to provide contact information for all parties involved in the transaction. By having the contact information for all parties, we are able to get everyone set up in the Portal, request important information, and begin the title and information gathering phase sooner.

For each party, you’ll provide the role in the transaction, first and last name, email address, and phone number. Even if you don’t have all the contact information, providing what you do have will give us a head start. We strongly encourage you not to skip this step.

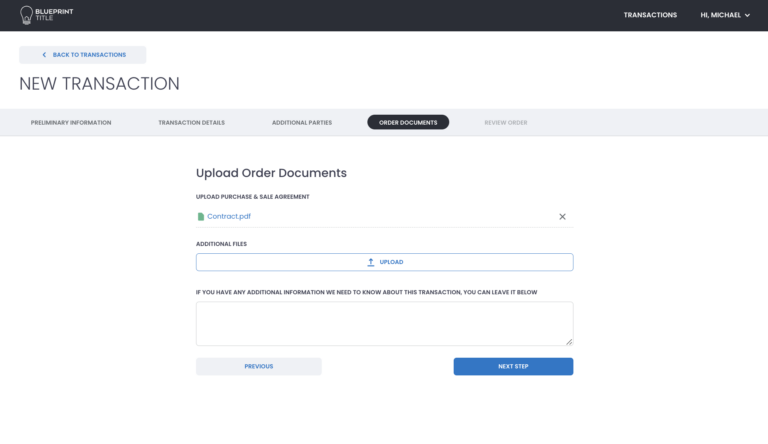

Step 4: Order Documents

In Step 4, you’ll upload the transaction documents into the Portal. At a minimum, we need either the purchase agreement or the title order for a refinance. However, providing as much relevant documentation as possible will allow us to move that much more quickly. The documents you provide are uploaded and stored securely in our encrypted database.

Here you can also provide additional relevant information. If there is anything about this transaction that you believe will help us progress your transaction, please feel free to provide it in the text box.

Step 5a: Checklist for Lender’s Policy

For refinance transactions, step 5 will include an endorsement checklist for the lender’s policy. This will ask you to confirm a variety of information with regard to the lender policy to be issued.

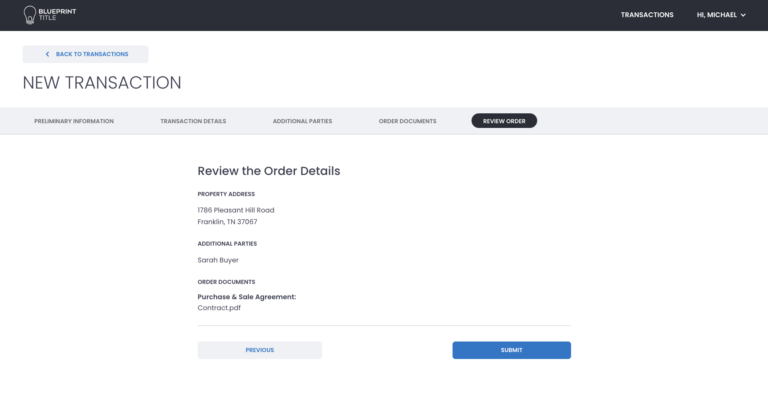

Step 5: Review

The final step in the process is to review your submission. In this step, you will see all the information you have provided, including uploaded documents. It is always a good idea to check this information again to make sure everything is accurate. The better the information you provide, the more effectively we can move your transaction forward.

Once you’ve reviewed all your information, click the blue “Submit” button to submit your transaction. At that time, we will be alerted to the new transaction and our team will begin its work.

Conclusion

Putting the power of submitting your transaction in your hands means that you can quickly and effectively get us started processing each transaction. We can focus on moving all your transactions from contract to closing, while you continue to grow your business.

We are constantly refining this process in order to create the most efficient workflow for you. If you have feedback, don’t hesitate to reach out.

*The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.